STOCK VALUATION

BRIEF CONCEPT

a. Zero growth

Where, Po = value of common stock

D1 = initial dividend

rs = required return of common stock

b. Constant Growth

Where, P0 = value of common stock

D1 = initial dividend

rs = required return on common stock

g = constant rate of growth in dividends

c. Variabel Growth

Where, P0 = value of common stock

D0 = the most recent dividend

g1 = initial dividend growth rate

g2 = subsequent dividend growth rate

rs = required return of common stock

n = last year of initial growth period

d. Free Cash Flow Value Entire Company

Where, Vs = value of common stock

Vc = value of the entire company

Vd = market value of the firm’s debt

Vp = market value of the preferred stock

FCF = free cash flow expected at the end of year t

ra = weighted average cost of capital

Other approach to common stock valuation

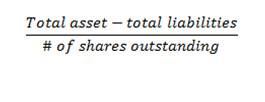

- Book Value

- Liquidation Value

- Price/earning multiple

Tidak ada komentar:

Posting Komentar